Tax Credit Information

1098-T: American Opportunity and Life Long Learning

West Chester University has contracted with Heartland ECSI to provide tax documents (1098-T forms) to our students.

West Chester University will send a 1098-T for each student on whose behalf payments for qualified tuition and related expenses have been received in an applicable tax year. If you give consent to receive your form electronically on the RamPortal, please understand that a paper copy of your 1098-T will NOT be mailed. For students that did not consent to an electronic form, their forms are mailed to the student’s home address on record by the end of January.

Current students can view their 1098T electronically in their RamPortal. To view your 1098-T form, go to RamPortal and select the Student Financials Tile. Click on "View Account Activity" to be redirected to TouchNet. Click on "My Account" and select statements to view your 1098 T tax statement. You will be redirected to the ECSI website where you can click on "View/Print Statements" on the right side of the screen.

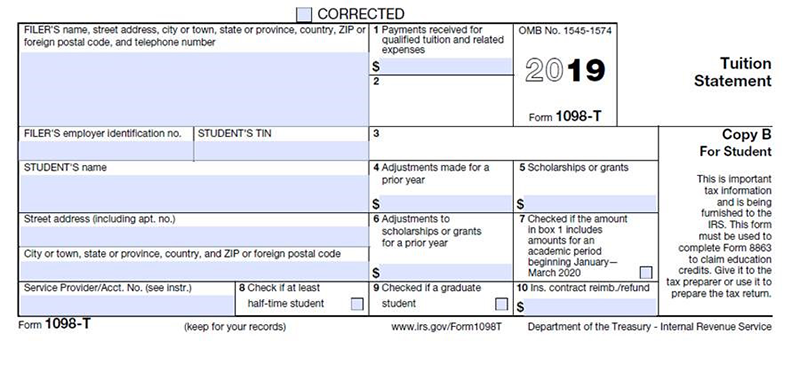

When you receive your tax document in 2025 for the 2024 tax year, you will see an amount in Box 1 (payments received for qualified tuition and related expenses.) Congress and the IRS eliminated the option for colleges and universities to report the "amount billed" on the form 1098-T. Colleges and universities must now report the "amount paid" for qualified tuition and expenses. This change went into effect for the 2018 tax year.

A Sample of the 1098-T form is provided below.

Please update your personal information in RamPortal to ensure the accuracy of your 1098-T form. (Name, home address and social security number/TIN or ITIN)

West Chester University is unable to provide you with individual tax advice or assist in calculating your tax credit. You may find detailed information about claiming education tax credits in the IRS Publication 970, page 9. If you have further tax related questions, please contact your tax professional.

For more information regarding the Federal Hope and Lifetime Learning Tax Credits, please click the links below.